Forex, or foreign exchange, is the global marketplace where traders can trade currencies. Forex is one of the largest and most liquid markets in the world. Here, traders buy and sell currencies in pairs, such as the EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), and many others. The value of these currencies fluctuates constantly. This is how traders profit: they try to buy at a cheaper price and sell at a higher price.

Table of contents

- What Is a Pip?

- How Does a Pip Work?

- Why Are Pips Important for Traders?

- How to Calculate a Pip?

- Pips in Different Financial Instruments

- Practical Examples of Using Pips

- Conclusion

If you want to start with Forex, you need to understand its basic terminology. The term “Pip” is one of the most important for those who want to know how to measure changes in currency values, calculate profits and losses, and manage risks. Here, we will check what a pip is, what role it plays, and how traders can use it for their activities.

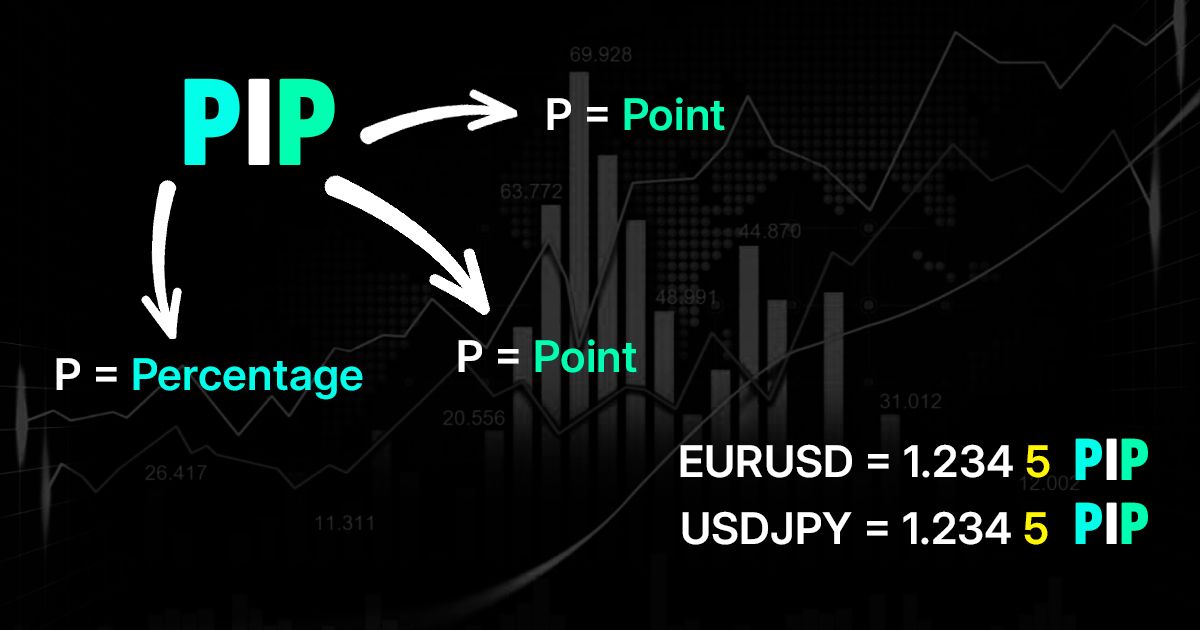

What Is a Pip?

A pip stands for "Percentage in Point" or "Price Interest Point." It is the smallest price move that a given exchange rate can make in the current market conditions. A pip is used to measure the change in value between two currencies in a currency pair. It is the smallest unit of price movement in Forex trading. It helps traders to quantify changes in currency prices.

In most currency pairs, a pip is equivalent to 0.0001 (one one-hundredth of a percent). For example, if the EUR/USD moves from 1.1050 to 1.1051, it has moved one pip. The pip is the fourth decimal point in most currency pairs, except for those involving the Japanese Yen. There, a pip is equivalent to 0.01 (the second decimal point).

It is very important for a trader to understand pips. It helps the trader to quantify the price movements, calculate potential profits and losses, and to manage risks overall. If a trader knows how to measure and track pips, he can make better trading decisions.

How Does a Pip Work?

A pip represents the smallest price movement in the Forex market. When a currency pair’s price moves by one pip, the change in the value of that crypto pair is reflected. A pip helps to break down price movements into measurable units.

For example, if the EUR/USD pair moves from 1.1050 to 1.1055, it has moved by 5 pips. Similarly, if the GBP/USD pair moves from 1.3050 to 1.3055, it also has moved by 5 pips.

Here is how pips work in different crypto pairs.

- EUR/USD: If the price of EUR/USD moves from 1.1200 to 1.1201, this is a 1 pip movement.

- GBP/USD: If the price of GBP/USD moves from 1.3100 to 1.3101, this is a 1 pip movement.

- USD/JPY: If the price of USD/JPY moves from 110.50 to 110.51, this is a 1 pip movement. As mentioned, the size of a pip is generally 0.0001 for most currency pairs, except for those with the Japanese Yen, where a pip is equal to 0.01.

Why Are Pips Important for Traders?

Pips are very important for Forex trading. They help traders to:

- Measure profit and loss: Traders use pips to measure how much they have gained or lost from a trade. For example, if you buy the EUR/USD at 1.1050 and sell it at 1.1070, you have gained 20 pips.

- Manage risks: Traders use pips to manage risks. They can determine with pips how far they can go if a trade moves against them. For example, a trader may set a stop-loss order at a certain pip distance to limit losses.

- Size positions: Pips also help traders determine the size of their positions. If a trader knows how many pips a trade can move, he can adjust his position size with his risk tolerance.

How to Calculate a Pip?

The pip calculation depends on the type of trade and the crypto pair. For example, you can calculate a pip like this.

Standard lots: A standard lot in Forex is 100,000 units of the base currency. Here is the formula to calculate a pip in a standard lot:

Pip Value = Lot Size×Pip Movement/Exchange Rate

For example, if the EUR/USD is trading at 1.1000 and you have a standard lot (100,000 units), a 1 pip movement would be: Pip Value =100,000×0.0001/1.1000 = 9.09 USD So, for every 1 pip movement, you make or lose approximately 9.09 USD.

Mini and micro lots: Mini lots represent 10,000 units of the base currency. Micro lots represent 1,000 units. To calculate the pip value for these smaller lots, you use a similar formula, just adjust it for the smaller lot size.

For example, with a mini lot (10,000 units) and if the EUR/USD exchange rate is 1.1000, a 1 pip movement would be: Pip Value=10,000×0.0001/1.1000=0.91 USD

If you trade a micro lot (1,000 units), you calculate the pip value: Pip Value=1,000×0.0001/1.1000=0.09 USD

Pairs with Japanese Yen: For currency pairs with the Japanese Yen a pip is 0.01, not 0.0001. So, if the USD/JPY pair moves from 110.00 to 110.01, it has moved by 1 pip.

Pips in Different Financial Instruments

Even though pips are normally used in the Forex market, they can be used for other markets, too. However, different markets still have their own terms to measure price movements.

In the stock market, price changes are typically measured in dollars and cents instead of pips. For example, if a stock moves from $50.00 to $50.50, it has moved by 50 cents, not 50 pips.

Commodities, such as gold or oil, measure price changes in price increments (for example, in dollars per ounce for gold). Indices, such as the S&P 500, are also measured in points.

Practical Examples of Using Pips

Let’s check how pips can impact trading decisions.

Example 1

If you buy EUR/USD at 1.2000 and sell it at 1.2050, the price has moved 50 pips. If you were trading a standard lot (100,000 units), your gain will be approximately 500 USD.

Example 2

If the GBP/USD moves from 1.3000 to 1.2950, this is a 50-pip movement in the opposite direction. If you were trading a standard lot, you would lose approximately 500 USD.

Conclusion

It is very important for a trader to understand pips. Pips help to measure price movements. With them, you can calculate profits ad losses, and manage risks better. This is why each trader shall learn how to work with pips.