You trade – we fund up to $200k

Trade with support. Entry from $24.

Why To Choose Supertrade?

150+ most popular and profitable trading assets

User-friendly interface with professional trading features

Up to 95% Profit Split

You keep from day 1. No scaling tiers, no hidden cuts

Instant Funding. Skip the challenge

$50K live account in 60 seconds

Entry from $24

Start with $200K capital. Lowest fee in the industry

Powered by Broctagon

lowest price in the industry

How it Works

Follow simple steps to get funded and trade profitably.

Choose a Funding Model

Start a 2-Phase Challenge with just $24 or get $100K capital in 60 seconds with Instant Funding.

Pass the Challenge

Prove your skill in 2 phases — hit profit targets while staying within drawdown limits. No time pressure.

Master the Live Account

Trade smart and earn big with 150+ assets.

Withdraw profits

Receive your share of the profits directly to your crypto wallet every month.

How Much You Can Make?

Make a living as a full-time proprietary trader without risking your own capital. Based on the statistics of our traders receiving payouts, they have an average monthly profit rate of 5.72%.

Estimate Your Profits!

Account Size:

Profit Rate

Take Home (On 90% Profit Split)

4.80%

Buckle Up, Your Journey Starts Here

We built our platform for maximum convenience, offering flexible account options to suit every trader. Choose 2-Phase Challenge to prove your skills step by step, or go Instant Funding for immediate access to a fully funded account. Whichever path you take, you trade with confidence on our transparent A-Book execution, designed to support your growth.

Fee Refund

Yes (after first payout)

Starting Balance

$2,500

Profit Targets

6% phase 1, 8% phase 2

Profit Split

80%

Daily Limit

Phase 1/2 – 7%, Live – 5%

Total Limit

Phase 1/2 – 7%, Live – 10%

Trading Duration

Unlimited

Platforms

YourFintech, MetaTrader 5

Leverage (Forex)

Up to 1:100

Leverage (Metals, Oil)

Up to 1:50

Leverage (Crypto)

Up to 1:2

Leverage (Indices)

Up to 1:50

Leverage (Stocks)

Up to 1:2

News Trading

Account size:

$2,500

Fee:

$24

Are you a new customer?

Get an even bigger 20% discount on your first purchase!

Challenge Completion Time

Trading Leverage (Details)

Hold Over Weekend

Trade Through News

Payouts to all over the world

OVER $2 MILLION

Earned by Traders at Supertrade

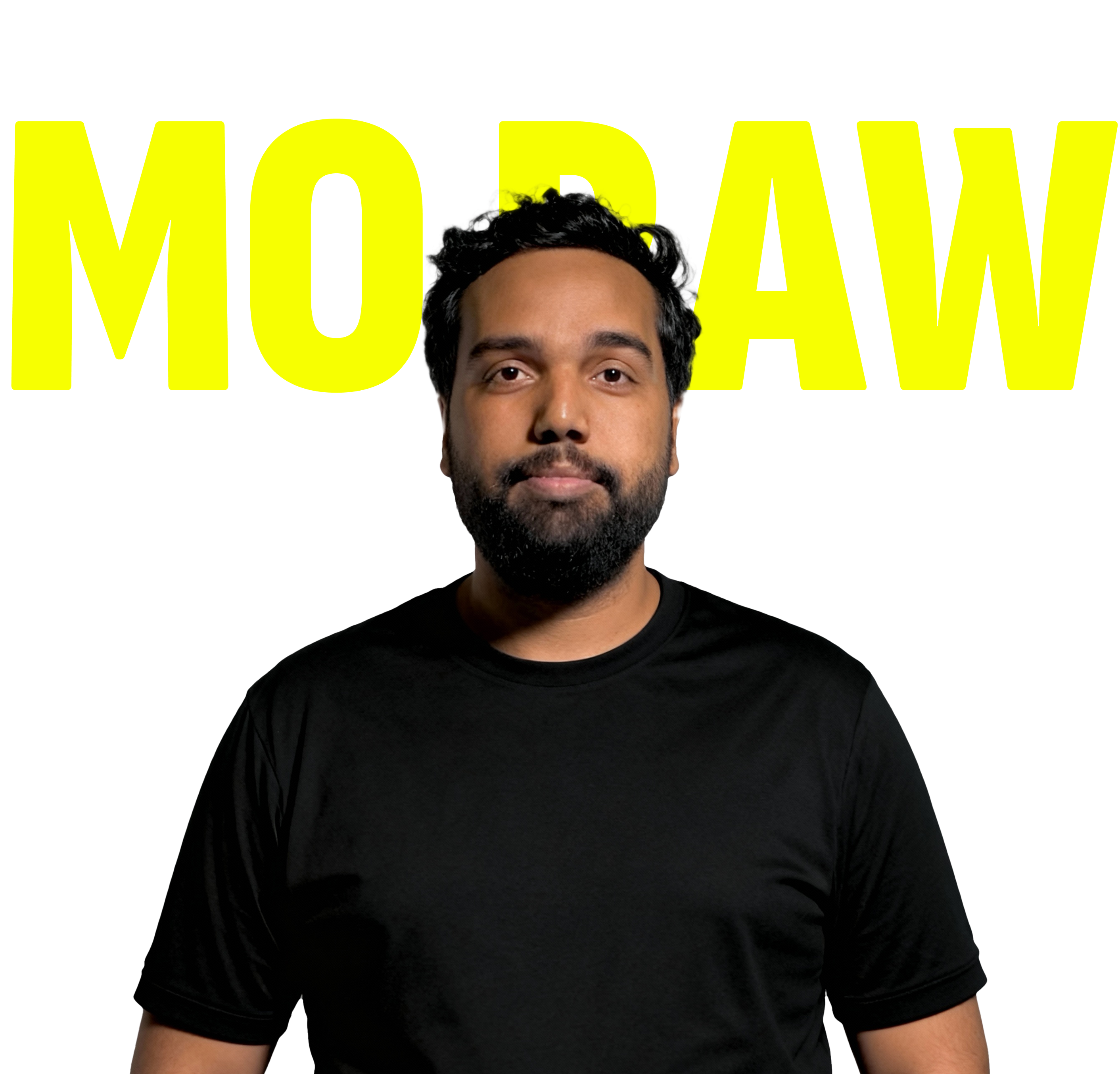

LEARN FROM THE TRADING ACADEMY OWNERS FOR FREE

SUPERTRADE LEAD COACH WITH 6 YEARS OF CRYPTO EXPERIENCE AND A 100K+ COMMUNITY

With two full market cycles of hands-on experience, he turns complex crypto trends into practical, actionable strategies. His approach is built on independent research, strict risk management, and real results. The same methods that helped thousands of traders succeed — now here to guide you every step of the way.

Happy Members

100,000+

Since Lanch

4YRS

Review Rare

4,9

Our super trading curators

Samson

Risk-first trader and TikTok educator known for "Minimum Risk, Maximum Consistency." He helps traders build discipline through viral content while staying profitable in real markets.

Michael Wrubel

"I skipped the challenges and went straight for the $5,000 funded account option. It was so quick and hassle-free. Supertrade is perfect for traders like me who want to dive right in and start earning!"

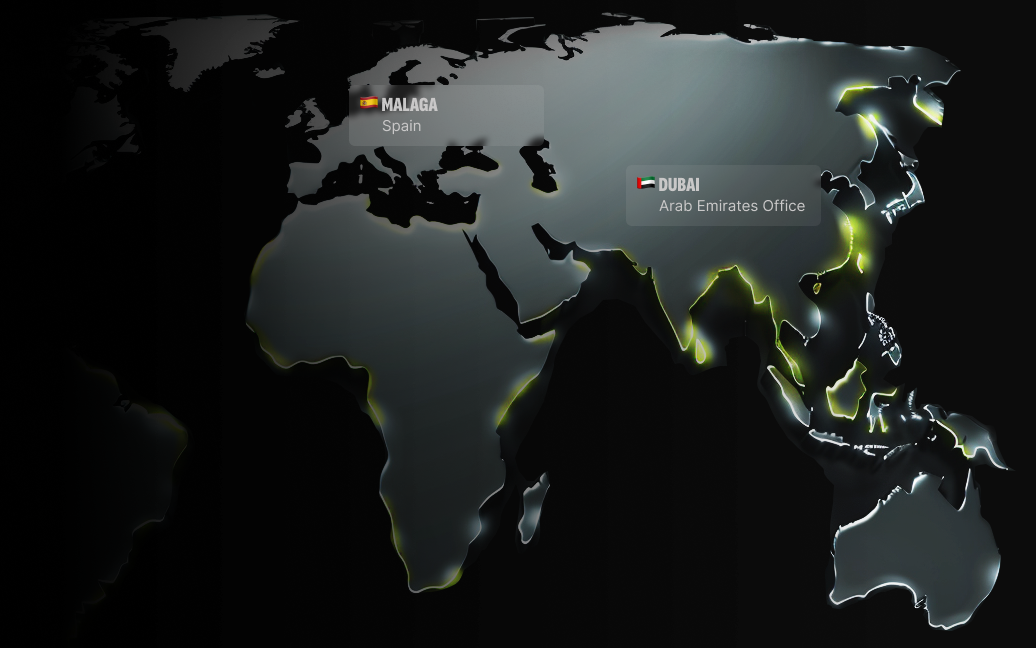

Global Presence, Dedicated Team

Supertrade is powered by a global team of over 80 dedicated professionals with extensive experience at Central Banks and the world’s leading proprietary trading firms.

Frequently Asked Questions

1

What is trading?

2

What are financial markets?

3

What is a trading instrument?

4

What is a trading terminal?

5

What is a trading account?